With Father’s Day just around the corner, many of us face the challenge of finding the perfect gift for our dads. Choosing a meaningful and useful present can be difficult, but it’s a special way to show our love and …

Tag Archives: online business

How Can Your Business Thrive Despite Economic Challenges?

Small and medium-sized businesses, from mom-and-pop shops to neighborhood stores and fast-growing restaurant chains, play a vital role in global economic growth and development. Thus, supporting their business growth with valuable insights and practical experience becomes crucial during challenging times. …

The Flutterwave Storefront Just Got Better With Our Latest Enhancements

In today’s competitive e-commerce industry, presenting a captivating and modern storefront is crucial to attracting and retaining customers. As usual, we at Flutterwave are committed to empowering businesses with tools for success. We are excited to announce the new updates …

Use Flutterwave Store Analytics to Unlock Your Business Growth

Running an online store is a great way to digitise and streamline your business, as it helps with order management, customers being able to shop directly without having to speak to you, fast and secure payments, and a wide customer …

Seven Tips and Tricks for Curating the Perfect Valentine’s Day Offers for Maximum Sales

February the 14th is around the corner. This means it is almost time for gift-buying for loved ones, friends, and families. For small business owners who know the drill, it could bring a lot of sales and more income. For …

Flutterwave’s #BattleOfTheBrands, Festival of Colours – A Fashion Show

For the past two years, we have been hosting remarkable trade fairs that showcase the incredible growth and business of SMEs that use Flutterwave Store and Flutterwave For Business. But now, we’re shaking things up by throwing a fashion show …

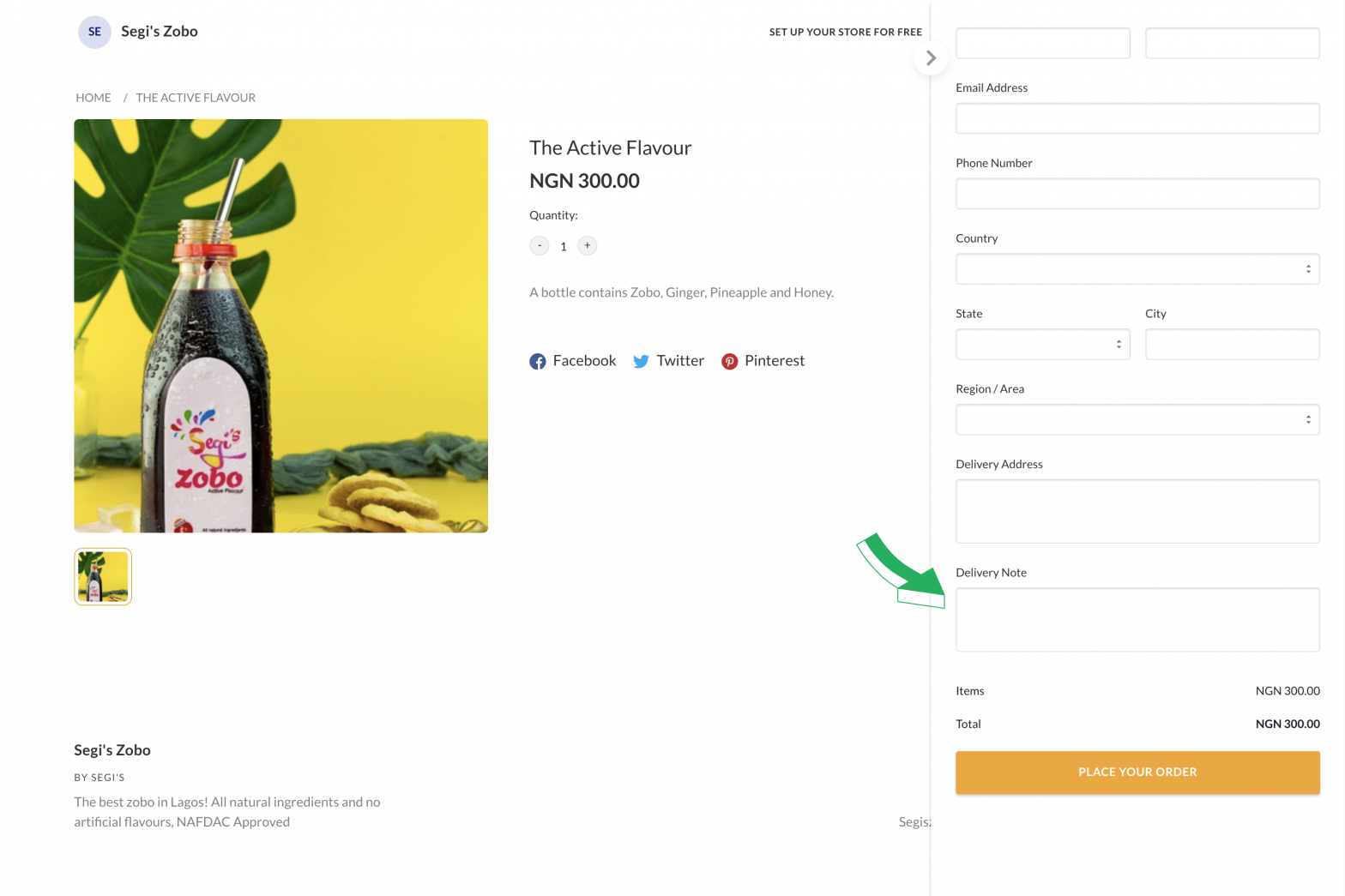

Flutterwave Store Update: How Delivery Note is going to give your Customers more options and grow your Business

Our mission at Flutterwave is, and remains “simplifying payments for endless possibilities.”

This to us means that every product, every feature, every move is a step towards creating endless possibilities for you.

The Flutterwave Store is a reflection of this. …

6 Tricks To Taking Better Photos That Could Guarantee More Sales

You currently run a business and you have decided to take it online, so you decided to create your store on the Flutterwave Store where you can start selling your products but in your heart, you know something is missing …

Here’s How To Safely Shop Online | Flutterwave

There are countless reasons to safely shop online today. There are even more reasons to simply shop online. The ability to compare prices from different stores to get great deals, a more comfortable and convenient method of shopping, having items …

Sip ‘n’ Paint + 9 other Flutterwave Stores you should check out this weekend

What are you doing this weekend? We have a few suggestions, wanna hear them?

Sip ‘n’ Paint with JustPaintNg

Where? Lagos, Nigeria.

What? Due to the Covid-19 pandemic, JustPaintNG set up an indoor sip ‘n’ paint event by delivering your …