9 weeks after we launched “Pay With Bank Transfer” we published this post asking how good it was.

The first question we knew you had was whether there were people using it, so we answered: 20,000+ in the first 9 weeks.

Fast-forward a year later and we want to find out how well this feature has done from the product team. We sat down with our Product Manager, Ted Oladele to ask a few questions about the Pay With Bank Transfer feature.

First of all, Ted, what do you think about our Pay With Bank Transfer Feature? Would you say it’s been a success?

I want to answer this without being biased. I’m saying this because it’s a feature I love for its simplicity and low maintenance. It’s basically running on its own without needing tinkering or checking on it every second. That said – and this is me not being biased – it’s been wildly successful. A lot of businesses that deal with high-value transactions have found it very convenient for their customers.

Why did the product team build Pay With Bank Transfer?

We built it because we needed to. Innovation for us is not about branding or nice rocket ship-sounding names. It’s about seeing into the future to create products that make life better for everyday people you’ll never meet. We looked at the data and realised that businesses were missing out on combining the customers’ most prevalent payment method with a powerful dashboard that brings their business together in one place. You could either accept payments by bank transfer or use a powerful dashboard to accept card payments. You couldn’t do both until June 2019 when we changed the game for our businesses. Innovation at Flutterwave means creating endless possibilities.

Why do people use it?

Because they’re used to bank transfers. As we highlighted when we launched this feature, the value of transactions via the Nigeria Interbank Settlement System Instant payment (NIBSS) system rose to N41.48tn in the first five months of 2019 – a 36% increase in the value of the transactions when compared with N30.448tn in the first five months of 2018.

It has a higher success rate. Like we announced after 9 weeks of implementing it, we witnessed almost 100% success rate on ALL Flutterwave Pay with Bank Transfer payment method transactions. This is largely because there’s no card to authenticate or any of other common issues that cause card payments to fail.

So, how does it work?

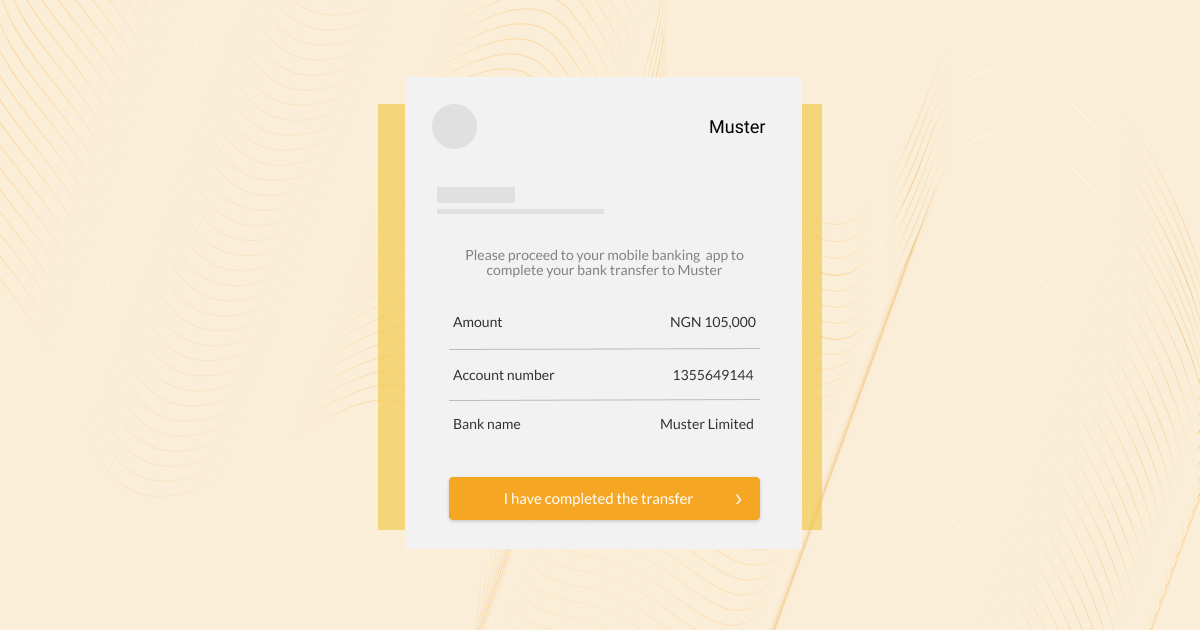

Well, it works in Nigeria for now. For businesses, they only have to enable “Pay With Bank Transfer” in their Payment Methods to have access to it. When a customer chooses the option, they’re given a temporary bank account to make a payment and that’s it.

For customers, they only need to select the Pay With Bank Transfer option on the checkout, make payment to the provided bank account and that’s it.

20,000+ transactions in the first 9 weeks of launching, what are the numbers today?

LOL! I’m sure most people were waiting for this. Well, with businesses like Binance, Chipper Cash, Quidax etc, our Pay With Bank Transfer payment method has witnessed 400,000+ successful transactions now and although I won’t give further numbers, majority of these are high-value transactions.

Is this because they trust this payment method more?

That definitely is a huge factor. We’ve done some research into it; a lot of people use it for high-value transactions. This is besides my earlier point about it being the most common method of transferring money in present day Nigeria.

What do you think the future holds for Pay With Bank Transfer?

For me, seeing a few competitors already implementing it, assures me that we are on the right track, and the vision we saw in 2019 was crystal clear. So, for the future I think that it ‘s going to be around here for a while. Its success rate, and current customer habit will keep it running. Businesses should definitely enable it as well as other payment methods to ensure they’re always on their payment collection A-game.

Businesses should also ensure they use Flutterwave (if they don’t already), to stay ahead of the curve.