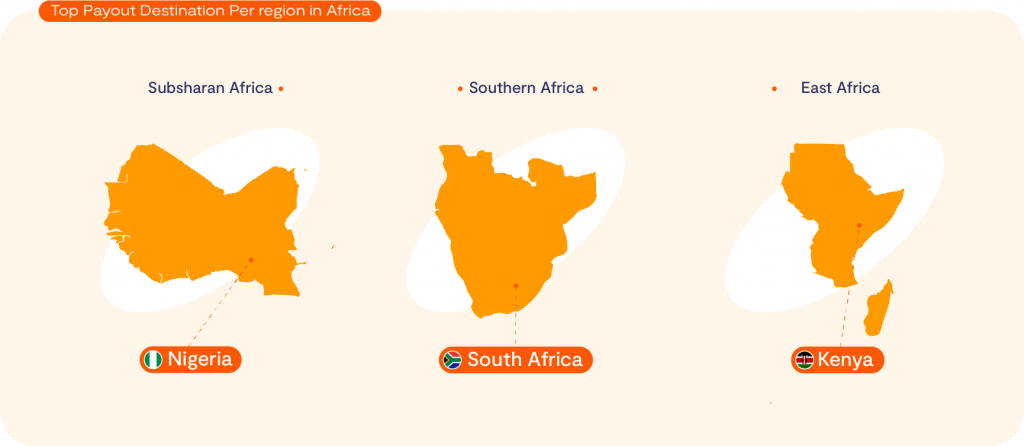

Africa is not a country. With 8 Regional Economic Communities, 2 Monetary Unions, and 33+ currencies – all with unique regulatory requirements – Africa is as diverse as it gets. This alone makes moving payouts seamlessly into the continent tricky.

If your business relies on processing payouts to African countries, then your priority would be understanding how to efficiently move money across the continent. Typically, you will be on the search for a financial provider with reach. Still, they would have to go beyond just being a single infrastructure to understanding how every step of processing payouts works on a country-by-country basis.

In this article, you’ll learn everything about processing payouts to Africa. From a brief history of its fragmentation to how this communication gap between regional systems has produced a language of real-time payment rails formed through expansions, network aggregation, and strategic partnership.

First: A Fragmented History

For Payouts to move in and out of a region seamlessly, it has to be plugged into the international financial ecosystem, which can be done in a few ways:

- Integration of local financial institutions into international messaging networks i.e. SWIFT (Society for Worldwide Interbank Financial Telecommunications).

- Through global banks operating in local economies of emerging countries.

- Partnerships between local and international financial services – which have to be justified by the remittance volume, or cost benefits, by this meter some countries will be left out.

Cornelius, Developer Experience Lead at Flutterwave explains here: This fragmentation doesn’t mean that Africa’s financial economy isn’t developed, it means that the economies develop independently. The drawback is a system with no singular communication channel, which means financial institutions have to customise their payout processes on a country-by-country basis. As such, enterprises that rely on processing bulk payouts to Africa need financial institutions with reach. However, the compliance cost of aggregating all rails in Africa is expensive so that kind of reach is rare. Due to this complexity, we’ve seen enterprises turn to multiple financial providers when they want to process payouts in different currencies across Africa.

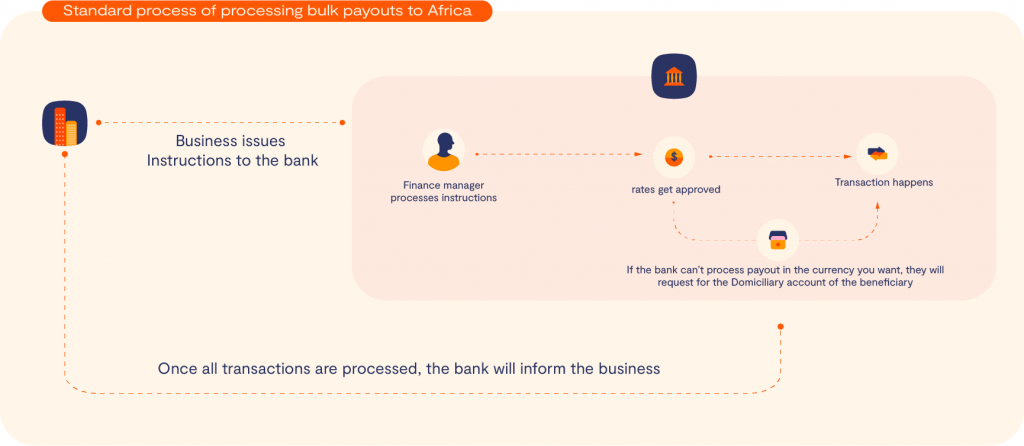

Here are some other limitations of this process:

- Long processing time: When traditional institutions can’t process payouts in a local currency, you must provide a domiciliary account or source another financial provider to handle the transactions, making the process longer.

- Speed: Payouts can take days to reach the beneficiaries due to regulatory requirements, which may affect the cash flow of beneficiaries who need funds now.

- Foreign Exchange Volatility: Exchange rates can be volatile on the African continent, so the longer the processing time the higher the probability of the exchange rate changing and transacting at a higher rate than earlier anticipated – so the faster, the better.

The Faster, The Better 💨

Africa is moving at the speed of now – transactions in most countries are processed within minutes regardless of the financial provider or payment method. For example, in 2011, Nigeria ranked 6th in the world’s most developed real-time payments markets, recording 3.7 billion real-time transactions in 2021.

In 2022, Kenya achieved full interoperability allowing customers to make real-time payments regardless of the network provider. This completes the person-to-person (P2P) interoperability policy implemented in 2018 by the Central Bank of Kenya. Essentially, prioritising fast payouts in Africa isn’t an option, but a necessity. Efficient and fast payouts aren’t only about speed and convenience, they allow businesses to take full advantage of market opportunities that present themselves daily, without waiting a minute.

Flutterwave: Powering Seamless Payouts To African Countries

Africa’s diverse market landscape necessitates tailored financial solutions, and Flutterwave has adeptly interconnected these markets while considering their unique characteristics. As an enterprise leveraging the Flutterwave network, you can seamlessly initiate payouts to over 33 countries across the continent, addressing the varied financial needs of each market.

In addition to facilitating payouts to over 33 African countries, Flutterwave’s comprehensive network ensures seamless transactions by accommodating various payout destinations such as banks, mobile money, and cash pickup. Whether it’s disbursing funds to individuals, employees, or business partners, Flutterwave’s platform provides a unified and efficient solution, allowing enterprises to navigate the complexities of Africa’s financial landscape with ease. Payments in emerging markets are usually challenging, expensive, unreliable and opaque. However, our switching operations processes strategically fix these pain points and, ultimately connect traditionally hard-to-reach regions to global financial infrastructure.

We’ve aggregated multiple payment rails and networks to allow you to move your money straight from your balance into the local accounts of the businesses you serve, no matter their currency. With real-time settlement and payouts, businesses can deliver a more wholesome experience to their customers on the continent.

Finally

We aim to consolidate all rails in Africa into a single API. With 630M+ transactions processed and an API connected to 150+ integrations across 50 countries, Flutterwave’s infrastructure is already built to handle high volumes in any currency within minutes. The possibilities are endless with Flutterwave Payouts, by providing businesses with fast, convenient, and reliable payouts, we’re not only helping businesses key into the growth opportunities in the continent but enabling them to gain a competitive edge.

If you’re thinking about processing payouts to Africa, let’s talk.