“How to send money to Nigeria from the USA?” “How to send USD to Nigeria?”

All these and more are questions that everyone has had for a while now but not anymore because Barter by Flutterwave is the answer.

As a company with presence in numerous countries, it is only right to be agile in responding to the fast-changing environment in which Barter operates. There had been a lot of uncertainty around remittance into Nigeria but not anymore. The Central Bank of Nigeria not only permits but also encourages the transfer of money to Nigeria to be paid in US Dollars Dom Account with cash pickup option. The Central Bank of Nigeria currently offers 5NGN for every 1USD received. This will definitely make a huge difference.

We are excited to announce that once again, Nigerian Barter users can continue to accept money from family and friends in the US, UK or EU.

So how can you send money to Nigeria from the USA? How does this work on Barter?

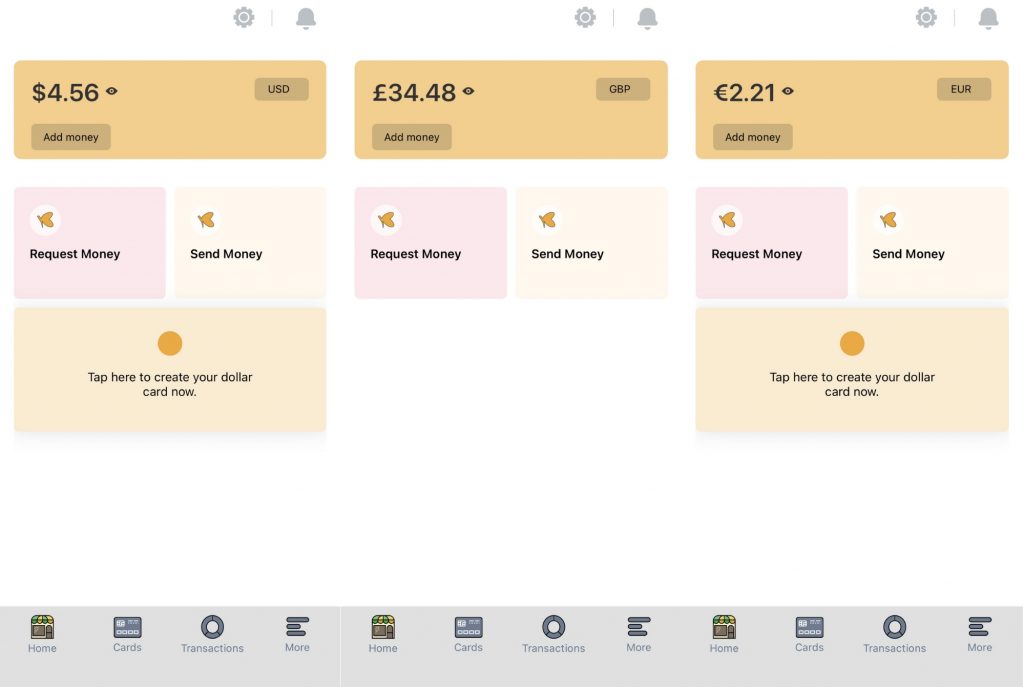

Barter users in Nigeria can receive money from other Barter users outside Nigeria directly in USD. Nigerian users who receive money from the US, UK or EU will have two balances in their Barter app, a USD balance for monies received from the US, UK or EU and an NGN balance.

- The process is really simple. The sender downloads Barter, and uses the “Send Money” button to send to the receiver in Nigeria.

- The USD sent automatically creates a USD balance beside the receiver’s NGN balance. You swipe left or right to move to either balance.

- That’s it. Your USD in your USD balance is available for use.

Monies received into the USD account can be cashed out into a DOM account or an NGN account. Barter users in the US, UK, and EU can also send remittances to Nigeria in USD by sending to a DOM account.

With this new feature, Barter users abroad can continue to send money to Nigeria without any hindrance. Nigerian Barter users can also enjoy the convenience of cashing out their USD balances in NGN without interruption.

FAQs

We expect you to have some questions and that’s why we have decided to answer some of the questions you may have below:

Is this new feature available to all Barter Users?

No, this new feature is only available for Barter users in Nigeria. We created this new feature because of the recent regulation by the Central Bank of Nigeria. Now, Nigerians can receive USD payments from the US, EU & UK into their Barter USD Balance.

As a Barter user in the US, UK or EU, how much will it cost to send USD to a USD Balance in Nigeria?

This is absolutely free.

As a Barter user in the US, UK or EU, how much will it cost to send USD to a Nigerian Domiciliary account?

Transfers to Nigerian Domiciliary accounts cost a flat fee of $3.

How much will it cost to send money from a USD Balance to a Nigerian Domiciliary account?

Transfers to Nigerian Domiciliary accounts cost a flat fee of $3.

How much will it cost for me to transfer from my USD Balance to my Nigerian bank account?

Transfers to Nigerian bank accounts are free.

How long will it take before money transferred from my USD Balance to my Naira bank account or Domiciliary bank account gets delivered?

Transferring USD from your USD Balance to your Naira bank account is instant! However, transferring to your domiciliary account will take 2 business days.

What’s the exchange rate for transferring USD from my USD Balance to my Nigerian bank account?

We will be using the prevailing rate offered by our partner Bank.

Thank you for trusting Barter on this journey as we continue to create endless possibilities for you.