If you’ve made it here, we’re going to assume you have a business website set up but now you’re asking yourself: how can I receive payments?

Online transactions happen quickly and easily when you are the customer but what about when you are the owner? What do I need? How is it set up? And is it safe? Let’s learn more about this technology and what you need to know to start accepting payments online.

How does a payment gateway work?

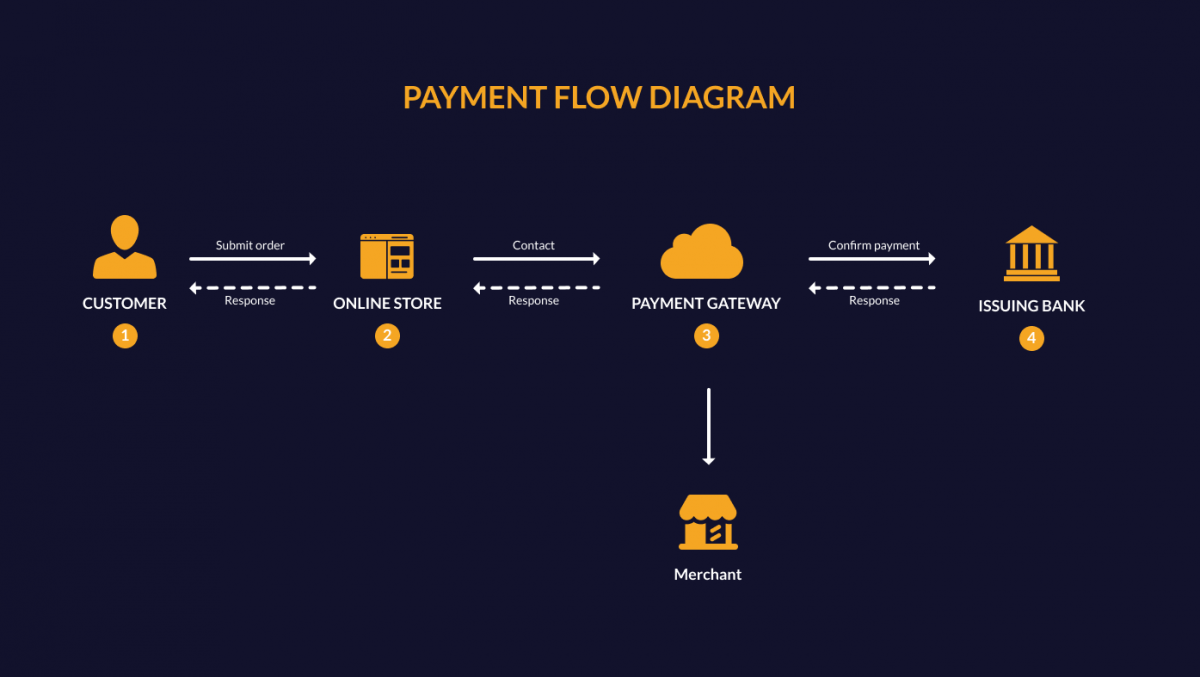

A payment gateway is a service that securely authorizes a customer’s payment on a website. You will need one to start accepting payments through your website, app or even social media. The diagram below shows a simple recap of exactly what happens when a sale happens!

After a quick search, it can be overwhelming to understand what you need for your business. There are quite a few steps to complete a transaction online that happens in only 2-3 seconds! After that, there are a couple more steps until the funds clear and are in your bank account.

A modern payment gateway like Rave by Flutterwave is an end-to-end solution that secures each step of the process. Unlike a payment processor, that only transmits the transaction information, a payment gateway will authorize it. Additionally, with a payment gateway like Rave by Flutterwave, you do not need a merchant account (a business bank account) to be able to receive your funds.

Choosing a payment gateway for your business

It’s easier to compare products if you know what you are looking for. If you haven’t signed up for a payment gateway before, keep in mind these priorities:

- How easy is it to set up? The benefit of a payment gateway is the “out-of-the-box” solution. For payment gateways, out-of-the-box should really mean there is no need for a developer or any extra steps more than a simple “insert account number here”. Most payment gateways offer a simple set up, and you shouldn’t settle for less! The purpose is to help get your business launched with the least hassles possible.

- How does it maintain security, avoid fraud and follow compliance? Accepting payments from a customer requires a secure network and PCI compliance. Rave by Flutterwave takes this one step further: adding a layer of protection with artificial intelligence. We scan every transaction for potential fraud and spot threats before they affect your business.

- What payment methods does it accept? You don’t want to lose a customer because you couldn’t accept their preferred payment method. Especially when expanding your business to a global market, each country has its own choice of what payment methods it trusts. This is why it’s important to use a payment gateway that accepts every major debit card, credit card, and alternative methods like ACH and mobile money. With Rave by Flutterwave, our core technology started with the purpose to expand the African market and connect it to the world. Thus, it is our focus to flawlessly accept payments from around the world.

- Does it meet my current needs…and future needs? Right now, you are trying to get the ball rolling. The first step is to accept payments online on your website, but does the payment gateway also help you with the second step, third step and so on? Look into the features you may need and make sure your choice includes them. Some of these features could include subscriptions, card issuing, split payments, and subaccounts. Getting the features you need will save you time from having to do this research all over again.

- How will my customers experience paying on my website? You might even ask, why does it matter how they do? Well, research shows that it does. Adding a trusted payment source to your website can increase the likelihood that you do make that sale. A payment gateway like Rave by Flutterwave is an example of a service your customers will trust. We have processed over 1 billion transactions in the last year and are used by merchants all over the world. Rave by Flutterwave can serve as it’s own pay me page and can integrate into your website or app. Providing the same seamless experience for your customers.

- What are the payment gateway fees? Even if you have clarified all the above, this may very well be your deciding factor. You want to include this in your operational costs and want to know what to expect. Rave by Flutterwave has no setup fees, no monthly fees, and no other hidden fees. We charge only by the transactions that are completed and we deposit your funds with reasonable flat rates. Go to our pricing page to see more about our charges, per payment type and country.

Conclusion: we’ve done our research, let’s get started!

A payment gateway is a service you need to start accepting payments online. You need to be able to trust this service with your business and your funds. With a payment gateway like Rave by Flutterwave, we are embarking on your journey and are here for the ride.

To learn more about businesses that chose us, check out our Rave Business Stories.

Frequently Asked Questions about Payment Gateway

What does it mean to be PCI compliant?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to ensure that companies that process, store or transmit credit card information maintain a secure environment. Flutterwave is Level 1 PCI Compliance, the highest level of compliance possible.

What currencies are supported?

We support payment in Naira, US Dollar, Euro, British Pound and many more. To see the full list of accepted currencies go to Accepted Currencies.

What e-commerce stores integrate with Rave by Flutterwave?

Our payment gateway integrates with the major e-commerce platforms like Shopify and WooCommerce. To see the full list go to Integrations.

What is Flutterwave?

Flutterwave is the award-winning technology that houses every part of your customer’s transactions and your payout. We have full control of the transactions processed because our solution is end-to-end. Our technology transits encrypted data from your website to your customer’s bank and authorizes it to send funds to your bank.

Do you have 24/7 customer service?

Our customer service runs 24/7 and we have chat support. We have a Slack community of developers, who are always looking for feedback to improve our service.

]]>