Ever been to a great event where a friendly but firm host checks invites at the door? They aren’t there to slow down the fun. They’re there to make sure everyone inside is safe, welcome, and ready to have a good time. By checking the guest list, they create a secure and trusted environment for everybody.

In the digital world, our Know Your Customer (KYC) process works a lot like that host.

It’s our way of doing a quick “ID check” to protect our community of businesses. This process is a crucial step we take together to protect your business, your customers, and the entire payment ecosystem. It is designed to give you the peace of mind to focus on what you do best: growing your business.

This guide will walk you through what our KYC process is all about, why it’s so important, and what you can expect.

What Exactly is KYC?

Think of KYC as a digital handshake. It’s a standard verification process that helps us confirm that you are who you say you are, and your business is exactly what you say it is. It’s not just a Flutterwave thing; it’s a global requirement for all financial institutions to keep everyone safe. In Nigeria, for instance, it’s guided by the Central Bank of Nigeria’s Customer Due Diligence Regulations 2023.

The goal is simple: to build a trusted environment where your business can thrive without the threat of fraud, money laundering, or other risks.

Why KYC Matters for Your Business

We know that providing documents can feel like a chore, but this process is designed with your best interests at heart. Here’s why it’s so important:

- It Protects You: By verifying the identity of every merchant, we build a secure platform and shield your business from potential fraud.

- It Builds Customer Trust: When your customers see you’re using a secure and compliant platform, it builds their confidence in your business.

- It Keeps Us All Compliant: Following these directives ensures compliance with regulatory requirements in all the markets we operate in.

The KYC Process

We’ve made our KYC process as straightforward as possible. It’s all about getting the right information about your account.

It is important to mention that KYC requirements vary depending on your business type and size – Sole Proprietorships (Business Names), Partnerships, Private Limited Companies, Public Limited Companies, Companies Limited by Guarantee, Unlimited Companies, and Non-Profit Organizations.

Furthermore, your line of business also determines the type of documents required for KYC, including Enhanced Customer Due Diligence (EDD) for merchants engaged in specific industries post-onboarding. For example, a remittance business looking to leverage Flutterwave’s payment solutions to serve its customers requires an International Money Transfer Operator (IMTO) license to operate. During KYC, the IMTO license must be submitted before we can grant them access to our services.

You can learn more about the documents required by Flutterwave during KYC in this support article. Below is an example of a typical KYC process:

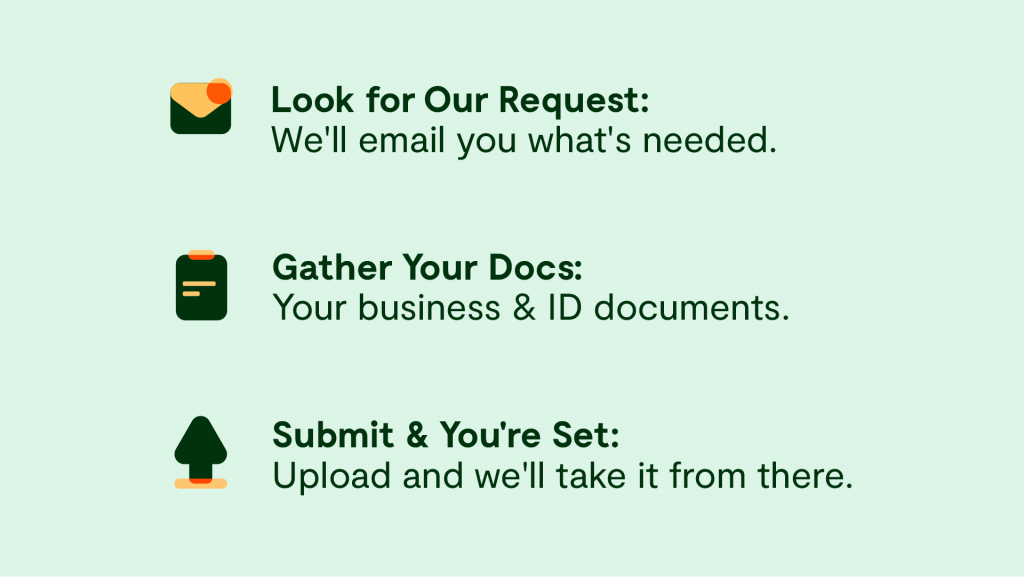

- Request For Documents

- For a new merchant: During the sign-up process, you’ll see a list of documents you need to submit to complete your KYC.

- For an existing merchant: We’ll send a “Request for Information” (RFI) to your registered email and your Flutterwave dashboard. This request will clearly outline everything we need.

- Gather Your Documents

The RFI will ask for documents to verify your company and the people behind it. This typically includes:- For your business: A Certificate of Incorporation and other business documents.

- For the people: A government-issued ID (like an international passport or driver’s license) for the business owners and key directors.

- Submit and You’re Set: Simply upload the required documents through your dashboard within the specified timeline, and our team will take it from there.

Is KYC a One-Time Thing?

To keep our platform consistently secure, KYC is not just a one-time check. We have a regulatory obligation to periodically review your information every 1, 3, or 5 years, depending on your type of business. Think of it as a routine safety check-up to ensure your information is always up-to-date and protected.

Tips for a Smooth Process

We want to get you verified as quickly as possible so you can focus on growing your business. Here are a few tips to help:

- Have your documents ready: Keeping digital copies of your key documents on hand can speed things up.

- Ensure everything is clear: Make sure your documents are clear, readable, and not expired.

- Ensure consistency: Ensure the name on your ID matches the name used for your business registration and your Flutterwave account. If they’re different for a valid reason (like a recent name change), having the supporting document (e.g., a marriage certificate) ready is a great idea.

- Check your website: A functioning website helps us understand your business better.

We’re Here To Help You Grow

Our KYC process isn’t here to block business; it’s here to enable it safely and securely. By partnering with us on this, you help us meet our regulatory duties and reinforce the trust that allows us to support your growth.

If you have any questions about our KYC process, please feel free to send us an email at [email protected], and our support team will be happy to respond to your questions.

Thank you for working with us to create a safer payment space for everyone.