1.4 billion people;

World’s youngest population;

Fastest-growing consumer market;

Booming fintech and mobile payments ecosystems;

Expanding middle class and largest free trade area globally;

There’s no doubt about it—doing business in Africa is highly rewarding. The continent’s commerce has experienced rapid growth over the past few years due to several factors, including a strong entrepreneurial spirit. This can-do spirit is embodied by both older and younger generations, resulting in significant progress as we often move from nothing to something. Yet, many challenges remain.

As a result, we organized a webinar tagged Money Moves: The Strategies of African Businesses Bet On (in 2025) on Wednesday, February 24, 2025. The event was moderated by our very own Oluwarotimi Okungbaye and featured business leaders from Air Peace, CDcare, and Flutterwave. This article rounds up the discussion, which focused on key challenges, untapped opportunities, and trends that indigenous businesses scaling global and multinationals coming into the continent need to consider.

The Impact of Currency Fluctuations

No matter your industry or region, currency volatility remains one of the biggest hurdles for businesses on the continent. Oluwatobi Odukoya, Co-Founder and CEO at CDcare, shared how his ‘Save Now Buy Later’ company restructured its cost management approach in 2024 due to fluctuating exchange rates.

“Many of our tech tools and gadgets were priced in dollars, making it increasingly expensive for customers. We had to rethink our strategy by ditching dollar-based tech tools and building our own in-house solutions to reduce costs.”

This emphasizes the need for African businesses to build resilience by reducing reliance on foreign-priced costs and adopting innovative cost-saving measures.

Contributing to the discourse, Opeoluwa Abitoye, VP of Relationship Management at Flutterwave, suggested that expanding into new countries and accepting foreign currencies like USD can help diversify income and protect against currency fluctuations. This is rooted in Flutterwave’s 2024 enterprise report, which noted that nearly 50% of the company’s merchants received payments from new locations during the past year.

Embracing Regional Integration and Global Expansions

Drawing from experience with Air Peace’s landmark Lagos-London route launched in 2024, Davids Odeyemi, Head of Sales and Business Development, noted that despite existing challenges, the African Continental Free Trade Area (AfCFTA) offers significant potential for regional trade. He highlighted considerable opportunities for business growth in key sectors, such as logistics, tourism, and AI-driven services across the continent.

“We see massive potential in AI-powered personalization, self-service innovations, and automation. Additionally, sustainability initiatives like green aviation and carbon offset programs are gaining traction, presenting long-term competitive advantages for businesses that quickly adapt to changes,” Davids said.

Undoubtedly, these factors and the rise of technology-driven services will make scaling easier, encouraging African businesses to build with a global mindset and consider expanding beyond the confines of a single market or region. Echoing Davids’ sentiment, Oluwarotimi emphasized the importance of “adhering to the highest regulatory and compliance standards as African businesses seek global expansions”

Digital Payment as a Key Driver for Growth

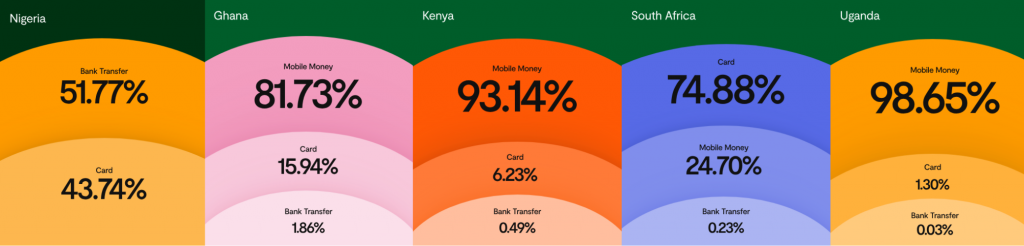

With Africa’s digital economy expanding rapidly, payment solutions are evolving to meet changing consumer needs. Opeoluwa emphasized the growing trend of cross-border payments on the continent and reiterated that Flutterwave’s “integration allows businesses to collect payments across different countries seamlessly.”

Opeoluwa further highlighted the importance of tailoring payment solutions to match regional preferences: “Understanding these unique payment preferences allows businesses to provide localized solutions that cater to their customers’ needs. At Flutterwave, we ensure that our integrations support the most widely used payment methods in each country.”

Rising E-Commerce and the Challenge of Credit-Scoring

By the end of this year, e-commerce is projected to add $180 billion to Africa’s GDP, and in five years, consumer spending is expected to reach $3 trillion. This showcases a promising future for commerce on the continent, particularly with the rise of installment-based payment models.

Oluwatobi highlighted the growing popularity of buy now, pay later (BNPL) services, noting that they are attracting attention across various sectors. “We’re seeing an increasing demand for installment payments on electronics, cars, and even real estate. Additionally, governments are showing interest in collaborating with private companies to expand credit access, enabling more people to acquire assets through structured financing,” he explained.

However, to effectively enhance consumer purchasing power through credit-based models, businesses and governments across the continent need to develop credit scoring systems and strategies that reflect both the broader African context and the specific cultural nuances of each country. This is particularly important considering that many African nations currently lack robust credit scoring systems.

However, to effectively enhance consumer purchasing power through credit-based models, businesses and governments across the continent need to develop credit scoring systems and strategies that reflect both the broader African context and the specific cultural nuances of each country. This is particularly important considering that many African nations currently lack robust credit scoring systems.

In Conclusion

As Africa continues to integrate into the global economy, innovation, digital transformation, and financial inclusion will remain key drivers of growth. Yes, there will be economic uncertainties, but resilient businesses that adapt quickly to changes and leverage the right network of partnerships will be well-positioned for success.

Since 2016, Flutterwave has been addressing a crucial aspect of business operations: processing payments. We are making it easier for businesses of African origin, no matter their size, to pay and get paid seamlessly across the world. Additionally, we provide reliable payment infrastructure for enterprise businesses like yours to easily deepen their presence or expand their reach on the continent. Let’s work together!