One of the toughest things about saving money is just getting started. As mentioned by Warren Buffet, “Do not save what is left after spending; instead, spend what is left after saving.” We all want to save money; whether it involves denying your sweet tooth that expensive snack or staying at home on a Friday night, everyone has their strategy to save money.

Today, we will share a few tips on how you can use a simple strategy with Barter to save for all your short and long-term savings goals.

1. Transfer Money To Your Cowrywise Account Using Barter

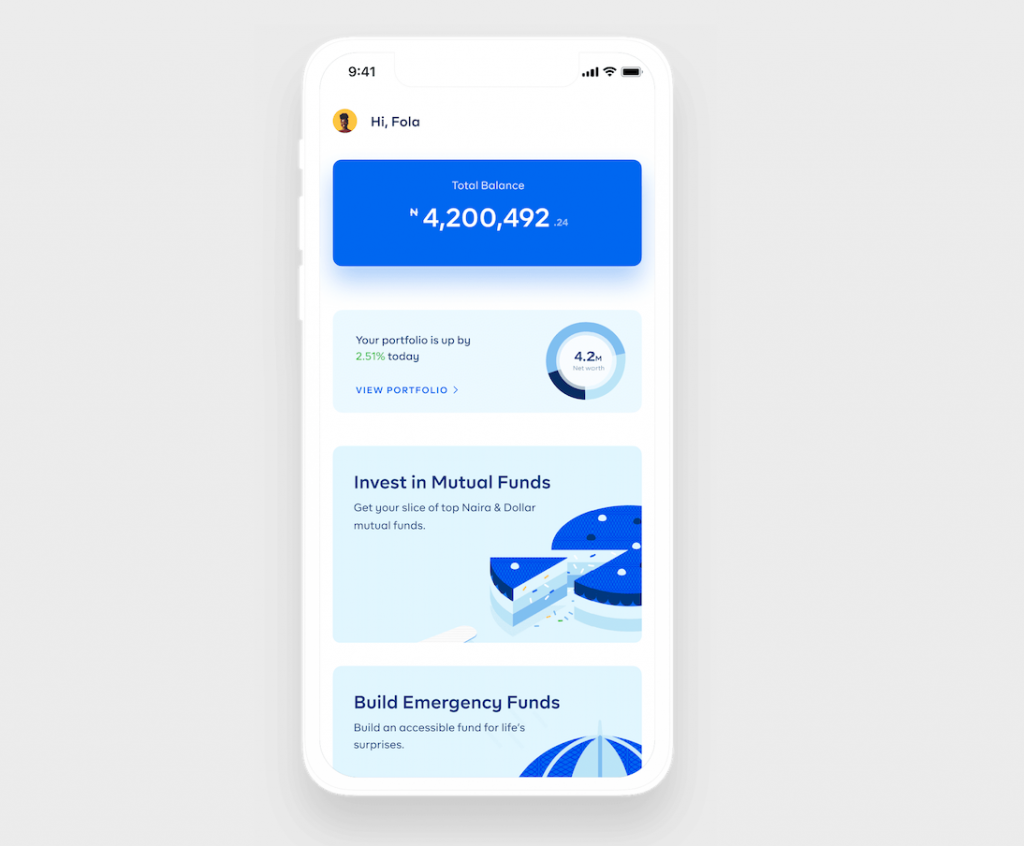

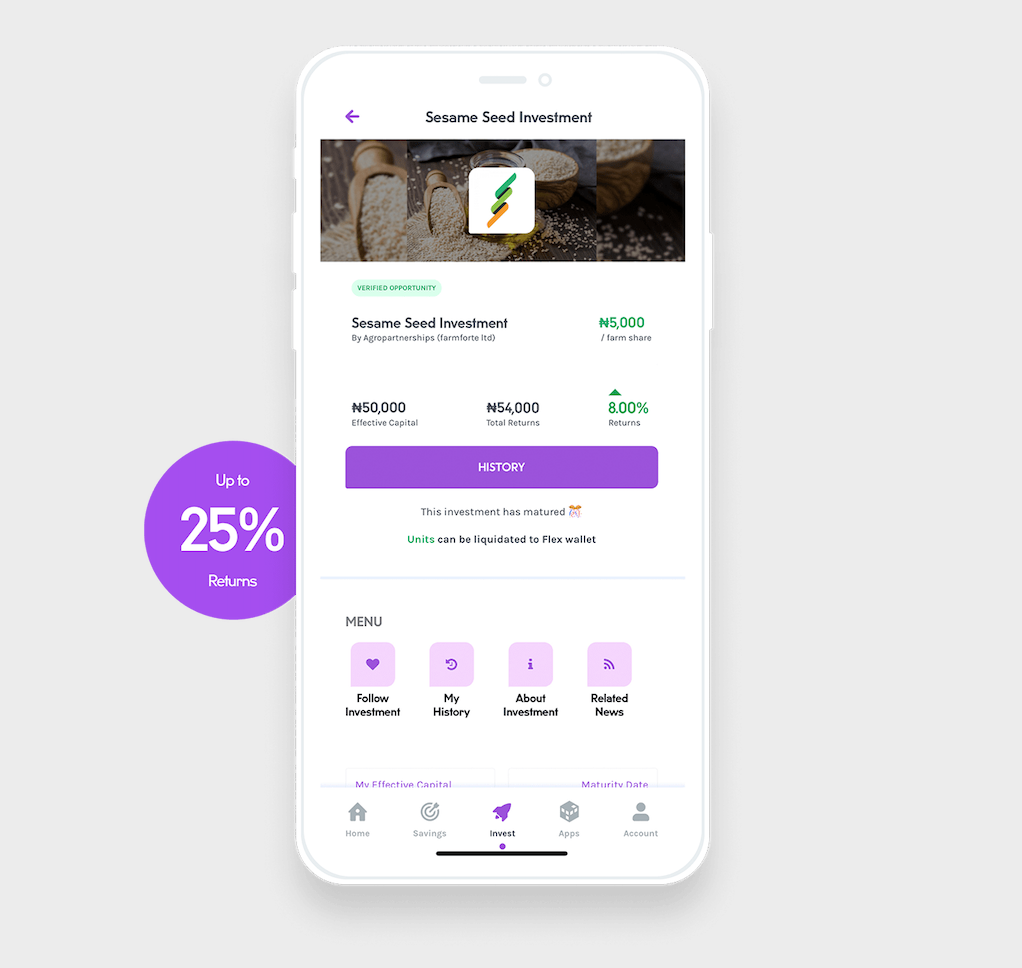

Cowrywise is a wealth management platform that provides its users with the ability to plan and manage their finances, save money, and invest in mutual funds simply through its mobile platform. With direct access to financial services and a pool of mutual funds in Nigeria, users can build their savings and investment portfolios online, manage their money securely, and plan out the best when it comes to their financial goals. Funding your Cowrywise account using Barter could be your first step to gain financial freedom.

How can you get started on this?

1. Do you have a Cowrywise account? If you do, proceed to step 2. If you don’t, click here to create a Cowrywise account.

2. If you have a Cowrywise account, do the following:

- Log into your Barter app.

- Click on Send Money.

- Click on the “Send to Cowrywise” option.

- Enter the amount you want to fund your account.

- Select “Send Money” and add your virtual bank account details as assigned to you by Cowrywise. Enter your pin and complete the transaction.

- That’s it; your Cowrywise Stash account gets topped up instantly.

2. Transfer Money To Your Piggyvest Account Using Barter

Piggyvest has over ₦1,000,000,000 securely saved monthly; users get to save funds that they would normally be tempted to spend impulsively. Piggyvest provides users with the ability to automate their savings and save towards multiple goals concurrently, as well as Safelock their money for a fixed period of time without access. PiggyVest uses the highest levels of Internet Security; it is secured by 256 bits of SSL security encryption to ensure that its users’ information is completely protected from fraud. Whether you are an avid saver already or just about to jump-start your savings, funding your PiggyVest using your Barter is the answer.

How can you get started on this?

1. Do you have a PIggyVest account? If you do, proceed to step 2. If you don’t, click here to create a PiggyVest account.

2. If you have a Piggyvest account, do the following:

- Log into your Barter app.

- Click on Send Money.

- Click on the “Send to PiggyVest” option.

- Enter the amount you want to fund your account

- Select “Send Money” and add your virtual bank account details as assigned to you by PiggyVest. Enter your pin and complete the transaction.

- That’s it; your Piggyvest Flex account gets topped up instantly.

3. Save Money On Your Barter Account

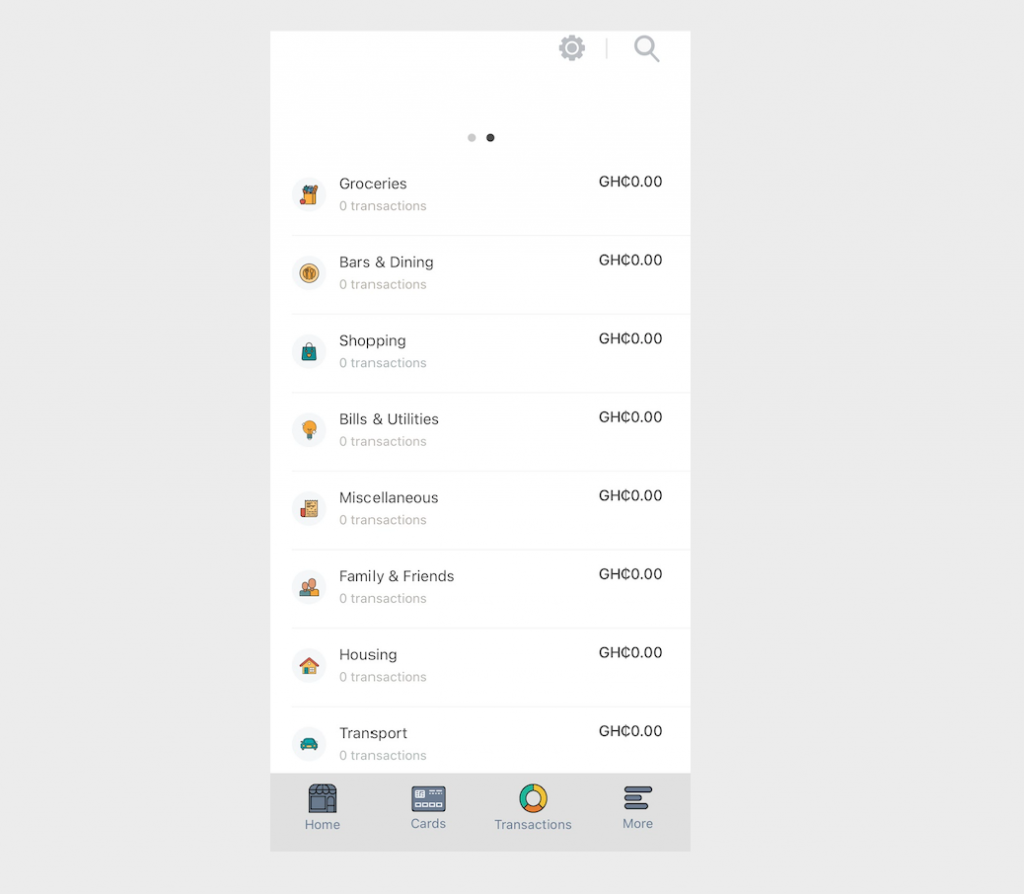

Budgeting is an important part of personal finance; however, the real secret to savings is tracking your day to day expenses. Most financially successful individuals know where exactly every single penny of their money goes; hence, they can make intentional choices to save money. When money is saved in Barter, every single penny that moves out of your account for day to day expenses is tracked, helping you keep good financial records.

Money sent to other Barter accounts is also instant and free from hidden charges, saving you ample time and money for other essential activities. Barter also grants you access to sending money abroad with no fees.

Everyone has different spending and savings habits; therefore, strategies will differ. As long as it works for you, think outside the box, go forth and prosper!