We all make card payments and most times they’re quite smooth but what actually happens behind the scenes? What leads to those other times when they’re not quite smooth? Those times when they pull errors, cause double debits, late debits, and other issues we’d rather not have. Today, we’re going to go under the hood, we’ll explain the card payment process, the common errors and what leads to them. Strap in, and enjoy the ride.

There are two sides to every payment. Your side, and the side of the business you’re trying to pay.

On your side, you’re issued a card that’s connected to your bank account by your bank, right? Right. By issuing that card to you, your bank is the “issuer” in this transaction. But where did the bank get the card, card number, and other details from? They got it from a card scheme e.g Mastercard, Visa, and Discover Global Network. Your bank issued you the card as authorized by the card scheme and the card scheme manages all the cards issued on their network globally.

Now, on to the business’ side…

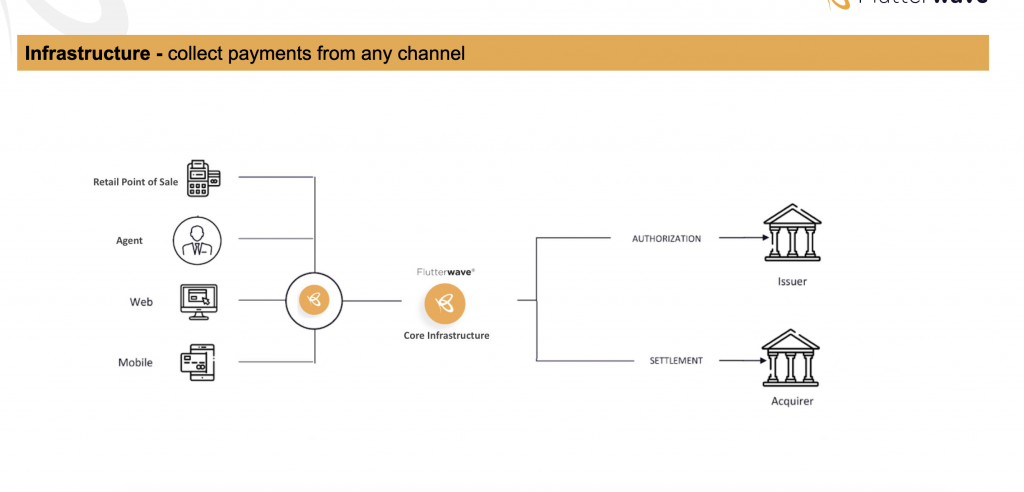

Flutterwave, like other payment processors, collects money on behalf of businesses (over 170,000 of them so far) but is unable to keep the collected monies because that is legally the exclusive reserve of financial institutions like banks.

This means that the payment processor needs a financial institution (bank) partner to keep the money collected on behalf of the business. This partner is called an “acquirer.”

How do all these come together, then?

When you put in your details to make a payment on a website powered by Flutterwave, Flutterwave as the payment processor and as licensed by the card schemes, first authenticates the card details, and confirms you’re the one trying to make the payment. Flutterwave then asks our bank partner(our acquirer), to collect the inputted amount from your bank.

That’s basically how payment works.

Payment processor checks that the issued card and details are correct, then asks the “acquirer” to collect the agreed amount on their behalf. The payment processor will eventually settle the sum to the business’ account.

So, essentially, when you input your details to make a $50 payment, you’re telling us: “I want you to debit $50 from my bank account and credit XYZ Limited with the same amount.”

What could go wrong?

Unfortunately, a lot.

If your bank (issuer) has not permitted your bank card for online payments, they’ll decline the request to debit your account.

If the payment processor’s bank partner (acquirer) fails to send the instruction to debit your account when they should, you might get a late debit.

If due to some technical error or some other reason, the payment processor’s bank partner (acquirer) sends the instruction to your bank to debit your account twice, you’ll get a double debit even though you only paid once.

If the payment processor’s bank partner (acquirer) makes a decision to outsource the process to a company that’s known for switching, there’s a chance that due to a backlog of requests from other acquiring banks they may end up making mistakes in trying to ask your bank to debit you and that can lead to a double debit.

The latter was actually one of the issues some of our customers faced recently and while we’re not happy with it, we’re at least glad that we’ve stuck with rectifying it for our customers and will continue to do so until the very last issue is resolved.

We are working with everyone involved to ensure every single customer affected gets their money back. It’s an automated process, so you can rest assured that you will get a refund.

A transaction can go wrong from the acquirer’s, acquirer’s agent or issuer’s end. When any of this happens, the customer deserves an explanation. More than anything, the customer deserves to know how payments work, to better understand what has indeed happened. That is the aim of this post.

When we say the world of payments is built on partnerships, we really do mean it. We, as a payment processing company are able to plug into the different payment methods and wallets on behalf of our merchants, receive payments, send to our acquiring bank and then settle our merchants.

Sometimes thinking about the process is confusing, but this is why our goal is to simplify it completely.

We’ll continue to do our best to support you if any issues arise, and most importantly, we are taking steps with our partner banks to ensure the issues are never experienced again.

Our focus remains on our customers and we will stop at nothing to simplify payment for endless possibilities, for you, our merchants, and indeed our partners.