Sticking to a budget is basically rocket science sometimes, it was probably extremely difficult for some of you to stay on a budget for Detty December. Yes or Yes?

Don’t lie, looking at your bank account and your spending during the holiday period was a little daunting. Many of us prioritized enjoyment over financial responsibility, what’s a budget to Detty December, right?

The forces have aligned in your favor, its a new year, so technically you now have a clean slate. All is forgiven, focus on the future. How will you be making better financial decisions in 2020?

Is it possible for you to be financially responsible and still have money set aside for Dec 2020 enjoyment? It is!

Here are a few tips to consider:

Set realistic financial goals

Before you add anything extra to your budget, you should pause and set your financial goals.

Why are you carrying out this exercise? What do you want to achieve? At the end of the year, what would you like to achieve? Are you saving for a mortgage? Do you want to go on holiday? Are you trying to be more financially responsible?

Breaking it down like this helps you prioritize. It makes it easier to plan your next move with finances.

Your Monthly Income

How much do you earn monthly?

How much are you willing to put aside for different expenses? Calculating your monthly income is important – are you earning solely from your monthly salary? Do you also have additional income streams that add up to your total monthly income?

If you are a business owner, this is a little trickier, if your business income is not fixed, you can calculate an average income over a certain period. Bear in mind, your income during the holiday season may be significantly higher than other seasons, if it’s not characteristic of other months of business, don’t forget to factor that in.

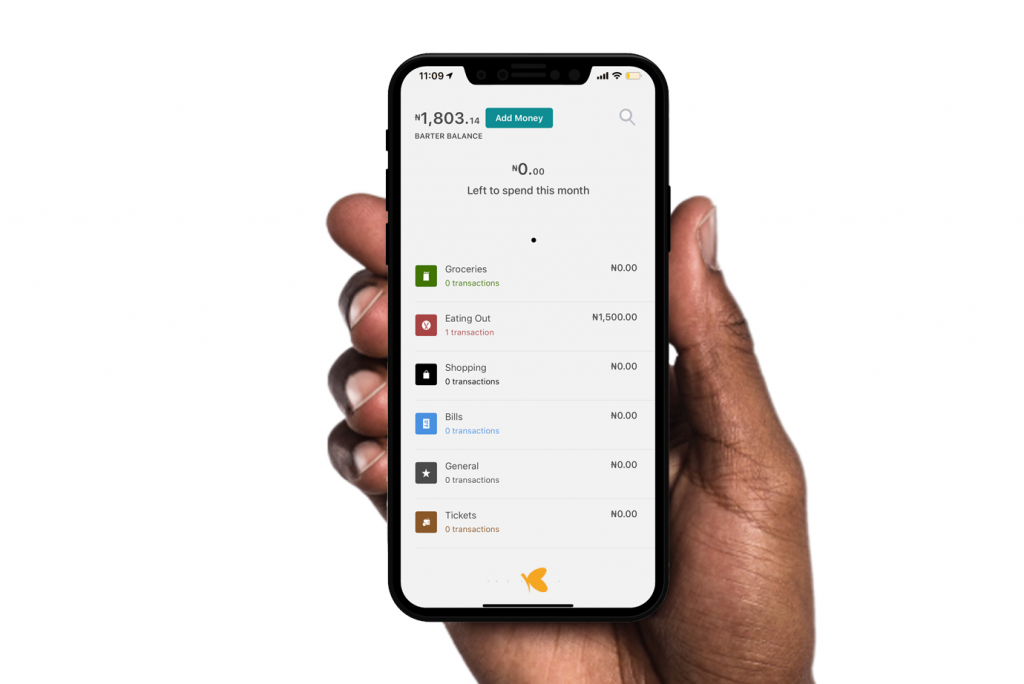

If you’re a Barter user, the Transaction tracker on Barter helps you keep track of inflow and outflow of income and gives you a clear outline of where your money comes from and where you spend on the most.

Estimate your fixed monthly expenses

Do a breakdown of all your expenses – utility bills, rent/mortgage, grocery costs, loan repayments, etc. Depending on how well you have been keeping track of your finances, this task may seem Herculean, but it’s really important to use realistic numbers because it’ll make your budget accurate.

Pro Tip: Use the categorization feature after every expense on Barter so you have a more robust picture of how you spend. It will help in determining your fixed monthly expenses.

Pro Tip Max: Be honest with yourself, it’ll help. Trust us.

Your Enjoyment Fund

Life is not only about the serious stuff, after prioritizing the important stuff – fixed monthly expenses, savings, etc. Now you can set aside your enjoyment fund. Anything from outings, vacations, self-care, gifts, and other enjoyment essentials.

Decide how you want to spend the rest of your money

So now you’ve set your financial goals, you’ve calculated your important monthly and annual expenses, your savings, and you even set aside some money purely for enjoyment. You still have some money left over, how do you want to spend that?

You could:

- Add it to your enjoyment budget

- Save it for emergencies [recommended]

- Use it for other causes, like charity donations, etc.

- Add it to your savings [recommended]

- Invest it on a periodic basis

The ones we recommend are saving for emergencies, because, well, life happens. Adding to your savings or investing the money.

If you fall into the other category where you have done a budget breakdown and compared it against your monthly earnings, and the numbers are somehow in the negative, you have to ask yourself some very tough questions and make some even tougher decisions regarding budgeting, spending, and saving. In all cases, ensure your set financial goals are being met before spending on too much enjoyment.