Insecurity, a Major Cause of Rising Inflation— Mr Godwin Emefiele (Governor of the Central Bank of Nigeria)

Mr Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN), has attributed the country’s rising inflation to worsening insecurity in parts of the country. Emefiele stated this on Tuesday 23rd of March, 2021, while presenting the communique from the Monetary Policy Committee (MPC) meeting which started on Monday 22nd March, 2021.

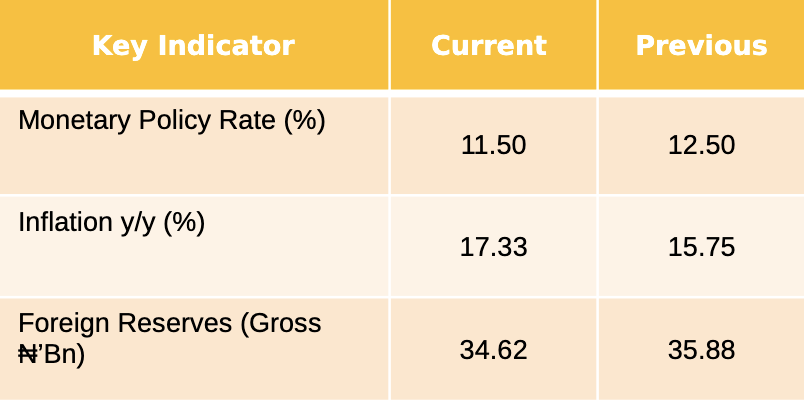

Emefiele explained that the inflation, which has increased for the 18th consecutive month, was exacerbated by food inflation. He said that insecurity in many food-producing areas of the country was a major contributing factor; “The MPC noted with concern the continued uptick in inflationary pressure for the 18th consecutive month as headline inflation continued on an upward to 17.33 percent at the end of February 2021 from 16.47 percent in January 2021. This increase continues to be attributed to both food and other core components of inflation.

This specific uptick in food inflation was the major driving factor for the uptick in headline inflation. This was due to the worsening security situation in many parts of the country, particularly the food-producing areas where farmers faced frequent attacks by herdsmen and bandits in their farms,’’ he said.” The apex bank’s governor said that while the bank was making significant intervention in the agricultural sector, the rising insecurity was limiting expected outcomes in terms of supply to the markets. He added that the situation was a major contributory factor to the rise in food prices.

Emefiele urged the Federal Government to collaborate with relevant stakeholders to urgently address the challenge of insecurity across the country.He said that the inflationary trend was also worsened by the hike in the pump price of petrol, the upward adjustment of electricity tariff as well as depreciation in the value of the Naira.

He, however, commended CBN’s various interventions to boost food security through its various agriculture programs.

Ships Divert from Suez Canal; Inflation Risks Emerge

The blockage of the Suez Canal wreaked havoc on global seaborne trade, raising the prospects of higher inflation with more ships ferrying cargoes and commodities forced to divert. A special dredger has also been deployed to free the vessel that has been stuck in the key waterway for days. Natural gas prices have increased, and food supply chains may have been affected.

Mark Ma, owner of China-based Seabay International Freight Forwarding Ltd., which has 20 to 30 containers waiting to cross the blocked canal, said that if traffic doesn’t resume in a week, “it will be horrible.” The pile-up of ships is creating another setback for global supply chains already strained by the e-commerce boom linked to the pandemic.

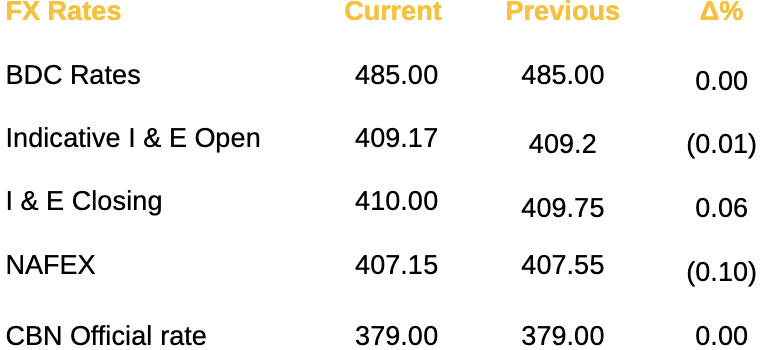

Naira Falls at NAFEX Window Despite 394% Increase in Dollar Supply

The exchange rate between the Naira and the US Dollar closed at N409.75/$1 at the Investors and Exporters window. Naira depreciated against the US Dollar on Thursday, 25th March 2021 after witnessing two consecutive gains at the NAFEX window to close at N409.75 to a dollar. This represents a 0.24% decline, when compared to N408.75/$1 recorded on Wednesday, 24th March 2021. However, in the parallel market, the Naira remained relatively stable, as it closed at N486/$1, which is the same as recorded in the previous trading session. Forex turnover on the other hand jumped by 394.4% from $34.76 million recorded on the previous day to $171.85 million as oil price continues its bearish trend.

List of Approved International Money Transfer Operator (IMTO)- CBN

The Central Bank of Nigeria (CBN) has released the list of approved/accredited International Money transfer Operators (IMTO). The list contains 47 approved operators in the Country.

Find list here.

The CBN still uphold its policy to the market that all IMTO beneficiaries have to be paid in USD, either via cash withdrawal or Bank account transfers.

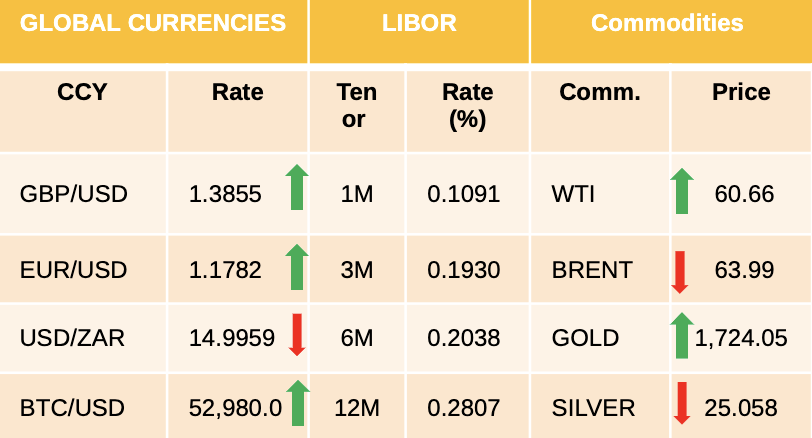

Global Currency, Fixings and Commodities

Monetary Indices

All Currency Rates, Fixings, Prices and Indices were obtained as of Friday, March 26, 2021

CBN Official Rate: This is the official rate at which direct transaction can be carried out with the CBN. This rate can only be obtained when direct deals or FX trades are done directly with the CBN.

BDC Rates (Bureau De Change): This refers to the FX rates obtainable for valid transactions at the Parallel market i.e Black Market or local Licensed BDC operators in Nigeria.

I & E Rates: The Investors’ & Exporters’ FX Window (I&E FX Window) is the market trading segment for Investors, Exporters and End users that allows for FX trades to be made at exchange rates determined based on prevailing market circumstances, thus ensuring efficient and effective price discovery in the Nigerian FX market. The I & E FX Window was established by the Central Bank of Nigeria (CBN) via a circular dated April 21, 2017

NAFEX – (The Nigerian Autonomous Foreign Exchange Fixing) is the reference rate for Spot FX operations in the Autonomous FX Market which comprises recognized FX trading segments, including but not limited to the Inter-bank market, the I&E FX Window and any such approved and recognized trading segment as may be defined from time to time. NAFEX is used in daily valuation and settlement of the OTC FX Futures Contracts.

Sources: FMDQ, Flutterwave Treasury Team, Abokifx, Proshare,.Bloomberg.com, Reuters, Nairametrics, FMDQ, Guardian

Disclaimer- This report is based on information obtained from various sources believed to be reliable and no representation is made that it is accurate or complete. Therefore, all rates shown here are mark to market rates being published for guidance purposes only. Reasonable care has been taken in preparing this document. Flutterwave Technology Solutions Ltd shall not accept responsibility or liability for errors of fact or any opinion expressed herein. This document is for information purposes and private circulation only and may not be reproduced, distributed or published by any recipient for any purpose without prior written consent of Flutterwave Technology Solutions Ltd.